According to straight line depreciation, the company machinery will depreciate $500 every year. The machine is estimated to have a useful life of 10 years and an estimated salvage value of $2,000. These two functions have the same syntax, but AMORDEGRC contains a depreciation coefficient by which depreciation is accelerated based on the useful life of the asset.

If that is the case, then the first year’s depreciation expense is prorated based on what percentage of the year the asset was in service. Then, the remainder of the first year’s partial depreciation expense is assigned to the final year of the assets useful life — as shown in the example below. QuickBooks Enterprise has a fixed asset manager that computes your depreciation expense automatically. You can also store other information like asset number, purchase date, cost, purchase description, serial number, warranty expiration date, and others. For tax purposes, straight-line depreciation can effectively spread the cost of an asset over its useful life, thereby reducing taxable income each year. This method is straightforward and widely accepted by tax authorities, making it a common choice for tax compliance and financial reporting.

- Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

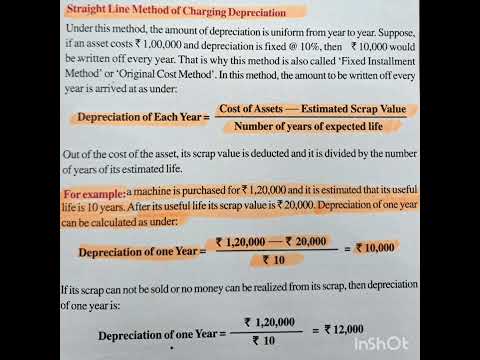

- This article defines straight-line depreciation and explains the depreciation formula.

- Suppose an asset for a business cost $11,000, will have a life of 5 years and a salvage value of $1,000.

- This method calculates annual depreciation based on the percentage of total units produced in a year.

- The asset’s cost subtracted from the salvage value of the asset is the depreciable base.

How to Calculate Straight Line Depreciation

You can always hire a professional accountant solution to handle this part of your business. The IRS has categorized depreciable assets into several property classes. These classes include properties that depreciate over three, five, ten, fifteen, twenty, and twenty-five years. The vehicle is estimated to have a useful life of 5 years and an estimated salvage of $15,000. You estimate the salvage value will be $2000, so the depreciation expense is now $4000.

Now that you know what straight-line depreciation is and why it’s important, let’s look at how to calculate it. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

Klicken Sie auf den unteren Button, um den Inhalt von YouTube nachzuladen.

Inhalt laden

It doesn’t matter if you own rental properties, are a small business owner or are an accountant. All of these individuals need to know how to calculate depreciation expense using the straight-line method of depreciation. The company expects the vehicle to be operational for 4 years at the end of which it can be sold for $5,000. Calculate depreciation expense using the straight line method for the year ended 31 Dec 2020, 2021, 2022 and 2023. The estimated useful life value used in our calculations are for illustration purposes.

The depreciation per unit is the depreciable base divided by the number of units produced over the life of the asset. In this case, the depreciable base is the $50,000 cost minus the $10,000 salvage value, or $40,000. Using the units-of-production method, we divide the $40,000 depreciable base by 100,000 units.

Straight-line depreciation formula

In turn, this caused the owners to mistake excess cash as being spendable profit. When you exchange cash for an asset, no immediate expense occurs because theoretically, you are simply exchanging one equal-valued asset for another. For example, if you were to exchange $10,000 cash for a machine valued at $10,000, theoretically you could immediately sell the machine for $10,000 without any loss. Enter the name or description of the property if you would like it included in the depreciation schedule. Calculate straight line depreciation for the first, final, and interim years of an asset’s useful life. Straight line depreciation and straight line amortization are calculated the same.

Create a free account to unlock this Template

Suppose a company purchases a machine for $10,000 with a useful life of 5 years and no salvage value. Using the straight-line method, the annual depreciation expense would be $2,000 ($10,000 divided by 5 years). Accountants are also responsible for selecting the appropriate accounting method for calculating depreciation.

- If you are adjusting the depreciation schedule for over or under-reporting depreciation in prior years, enter the remaining depreciable base.

- Under the MACRS, businesses can deduct the cost of assets over a predetermined period of time, based on the asset’s useful life.

- With these numbers on hand, you’ll be able to use the straight-line depreciation formula to determine the amount of depreciation for an asset on an annual or monthly basis.

There are several how to calculate straight line depreciation types of depreciation methods that businesses can use to calculate the depreciation expense of their assets. Each method has its own advantages and disadvantages, depending on the type of asset and the business’s needs. The balance sheet is a financial statement that shows the assets, liabilities, and equity of a company at a particular point in time.

Time Value of Money

Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset. A company may elect to use one depreciation method over another in order to gain tax or cash flow advantages. It is a simple method that evenly distributes the cost of an asset over its useful life. To calculate the annual depreciation expense, the cost of the asset is divided by the number of years of its useful life. The depreciation of an asset depends on how you use the asset to generate revenue.

You can avoid incurring a large expense in a single accounting period by using depreciation, which can hurt both your balance sheet and your income statement. Depreciation accounting necessarily involves a continuous succession of journal entries to charge a fixed asset to the expense and, eventually, to derecognize it. These double entries are intended to reflect the continuous use of fixed assets over time. Depreciating assets, including fixed assets, allows businesses to generate revenue while expensing a portion of the asset’s cost each year it has been used. If your company uses a piece of equipment, you should see more depreciation when you use the machinery to produce more units of a commodity.

ACCOUNTING for Everyone

The business’s use of the machine fluctuates greatly, according to production levels. The business expects the machine to produce 100,000 units over its useful life. The expense is posted to the income statement, and the accumulated depreciation is recorded in the balance sheet. Accumulated depreciation is a contra asset account, so the balance is a negative asset account balance. This account accumulates the depreciation posted each year, and each asset has a unique accumulated depreciation account. The depreciation journal entry can be a simple entry that facilitates all types of fixed assets, or it can be broken down into separate entries for each type of tangible asset.

Capital expenditures are the costs incurred to repair assets and purchase assets. Each year, the book value is reduced by the amount of annual depreciation. Remember that the salvage amount was not subtracted when the depreciation process started. When the book value reaches $30,000, depreciation stops because the asset will be sold for the salvage amount. On top of that, it is worth it for small business owners, larger businesses and anyone owning a rental, to familiarize themselves with Section 179 depreciation and bonus depreciation. But, you don’t have to do it yourself, especially if you run a large company with many assets that are liable to depreciation.

So if you have a question about the calculator’s subject, please seek out the help of someone who is an expert in the subject. If you have a question about the calculator’s operation, please enter your question, your first name, and a valid email address. With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients. When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility. Knowing the right forms and documents to claim each credit and deduction is daunting. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands.

Klicken Sie auf den unteren Button, um den Inhalt von YouTube nachzuladen.

Inhalt laden

Leave A Comment