A high ratio means the firm is highly levered (using a large amount of debt to finance its assets). There are various leverage ratios, and each of them is calculated differently. In many cases, it involves dividing a company’s debt by something else, such as shareholders equity, total capital, or EBITDA.

key strategies for managing and optimising financial leverage ratio

A rising ratio means consumers are taking on more debt relative to income, signalling potential reductions in consumer spending that could negatively impact stocks. For example, a company C has Rs. 3 million in total assets and Rs. 1 million in shareholders’ equity. For example, a company has Rs. 2 million in total debt and Rs. 5 million in shareholders’ equity. During an economic downturn, Company A experiences a significant drop in sales. As a result of its high operating leverage, its profits plummet even more due to the fixed costs it must cover.

- Again, what constitutes a reasonable debt-to-capital ratio depends on the industry.

- In the process, companies borrow finances instead of issuing stocks to investors to raise capital.

- Excessive leverage imposes risks that ultimately harm shareholder value.

- In practice, the financial leverage ratio is used to analyze the credit risk of a potential borrower, most often by lenders.

- Leverage ratios help investors discern a company’s ability to adapt and take advantage of future opportunities.

What Is a Leverage Ratio?

It’s essential for companies financial leverage formula to balance the benefits and risks of leverage based on their specific circumstances and objectives. A leverage ratio is a financial measurement that assesses how much of a firm’s capital is derived from debt, such as loans. It evaluates the firm’s ability to fulfill its financial obligations.

A higher leverage ratio indicates greater financial leverage and debt burden on the company. Leverage ratios are financial metrics that measure a company’s ability to meet its debt obligations. Leverage ratios are important indicators of a company’s financial health and stability. A high leverage ratio means a company has taken on significant debt relative to its equity or assets. This makes the company riskier for investors, as high debt levels mean the company must direct more cash flow to make interest payments rather than investing for growth. In a recession, the financial ratio of debt to equity, a measure of leverage, becomes critically important.

Financial Leverage: Definition, Calculation and Importance

Therefore, a debt-to-equity ratio of .5 ($1 of debt for every $2 of equity) may still be considered high for this industry. Suppose we’re tasked with calculating the financial leverage ratio of a company as of 2022. Both companies pay an annual rent, which is their only fixed expense.

The debt ratio measures the percentage of a company’s assets financed through debt. Infosys has total assets of ₹1,28,000 crore and total debt of ₹3,420 crore on its balance sheet. Investors use the equity ratio to screen for stocks with strong balance sheets and lower financial risks. Comparing the ratio over time shows the changing capital structure of a company. Analysts view an increasing equity ratio as the company maturing and lowering risk.

What is Business Loan?

For example, utility stocks safely sustain very high leverage ratios, thanks to their recession-proof demand and stable earnings and cash flows. On the other hand, cyclical sectors like auto manufacturers cannot prudently carry nearly as much debt. The net leverage of just 0.064x reflects Infosys’ miniscule net debt compared to strong operating cash flows. This gives it substantial financial headroom to invest in future growth initiatives. Conservative leverage benefits stock investors by minimizing balance sheet risk.

Klicken Sie auf den unteren Button, um den Inhalt von YouTube nachzuladen.

Inhalt laden

The equity multiplier ratio measures the amount of assets financed by each rupee of shareholder equity. The equity ratio measures the proportion of total assets financed by shareholders’ equity. The asset to equity ratio measures the proportional amount of assets to shareholder equity in a company. It is calculated by dividing total assets by total shareholders’ equity. The debt to asset ratio is an important metric for stock investors to gauge a company’s financial risk. It increases a company’s risk of default and results in higher borrowing costs.

Comparing the ratio over time or between peers shows the changing capital structure and risk profile of a company. While higher leverage boosts returns, it also exposes shareholders to higher risk if the company cannot meet debt payments. A lower equity multiplier signals the company relies less on debt financing. For example, a company A has Rs. 2 million in total assets and Rs. 1 million in shareholders’ equity. For example, a company has Rs. 2 million in total liabilities and Rs. 5 million in shareholders’ equity. The debt ratio, also called the debt-to-assets ratio, measures the amount of debt a company has relative to its total assets.

Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone. If Company XYZ opts for the equity route, it means they are willing to give away a part of their company to own the asset. In this case, they will fully own the asset from the beginning, and there won’t be any interest payments involved. Here is an example that will help you understand how financial leverage works. The differences between operating and financial leverage are represented in the table below.

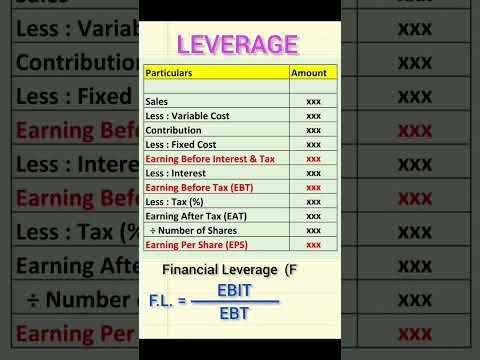

The value of DFL is important to assess the valuation of financial leverage and determine how businesses can streamline processes to reduce monetary obligations. However, if the firm operates in such a sector where operating income is volatile, it is always recommended to limit debts to a manageable and easy level. Similarly to the degree of operating leverage, DFL represents the changes of two variables. These are the percentage change in earnings per share (EPS) and percentage change in earnings before interest and taxes (EBIT).

What does high leverage ratio mean?

- Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

- The fixed charge coverage ratio measures a company’s ability to cover fixed expenses like debt payments, interest, leases, and rent.

- The company must be compared to similar companies in the same industry or through its historical financials to determine if it has a good leverage ratio.

- This allows the investor to control a greater number of shares and benefit more from potential gains, but it also exposes them to greater losses if the share price declines.

Here is a real-life scenario where the debt and EPS of Nestle for two consecutive years – 2014 and 2015 – have been mentioned. In addition, the leverage is calculated using the formula above with respect to their debt to equity ratio. Financial leverage is an investment strategy where businesses borrow money to buy assets and increase capital to expand their venture. The firms opt for this option only when they know that their investment has the potential to generate profits that could easily help them pay back their debt. To calculate this ratio, find the company’s earnings before interest and taxes (EBIT), then divide by the interest expense of long-term debts. Use pretax earnings because interest is tax-deductible; the full amount of earnings can eventually be used to pay interest.

The following year’s EPS would grow by 20% to Rs. 0.60 if operating income increased by 10% to Rs. 110,000 and interest remained the same. For example, suppose a company with $1 million in assets finances $800,000 through debt and $200,000 through equity. If the company earns $200,000 in profit, it has an annual return on equity of 100%. However, if the company finances the entire $1 million through equity, the return on equity would only be 20%. Similar to the Times Interest Earned ratio, but includes lease payments. This provides a broader picture of a company’s ability to cover fixed obligations.

And country risk varies—debt levels considered safe in the U.S. could be risky in emerging markets. But simple leverage ratios treat all sectors and geographies equally. To fully assess leverage, ratios should be viewed within relevant risk contexts. Meanwhile, Reliance Industries’ relatively lower leverage ratios demonstrate a more conservative financial profile, with less dependence on debt. It has a substantial equity base and finances just over one-third of its assets through debt.

Klicken Sie auf den unteren Button, um den Inhalt von YouTube nachzuladen.

Inhalt laden

Leave A Comment